The greater Sacramento area is a hotbed for new businesses. Everything from small “mom and pop” shops to blue-chip tech companies have opened or relocated here.

Office parks and industrial parks are experiencing a resurgence.

If you are considering starting or relocating a business to this part of California, there are a few essential things to know beforehand.

First, you’ll need to determine if you’ll be required to apply for a business license. Not everyone needs a Sacramento business license. Whether or not you’ll need to get one will depend on which area you plan to open and/or operate in.

These three jurisdictions have different business license requirements:

- City of Sacramento

- Unincorporated Sacramento County

- West Sacramento

Depending on your business’s location, there are different license requirements.

City of Sacramento Business License

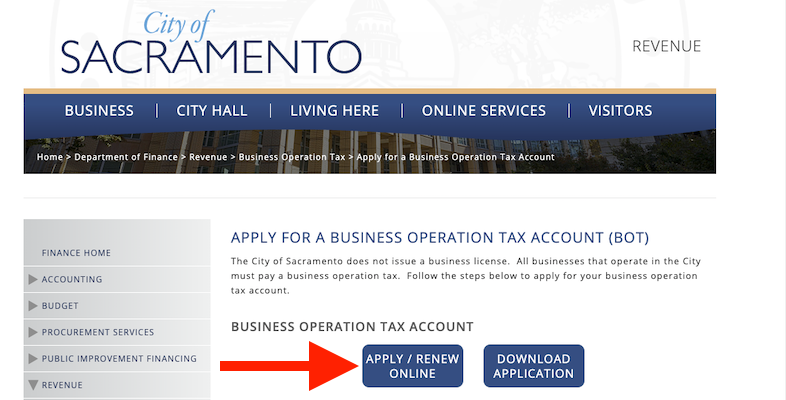

The City of Sacramento does not require you to get a business license to open and run a business. However, the city requires you to pay a business operation tax (BOT).

You’ll need to apply for a Business Operation Tax Account. The form will ask you for some basic information about your business, including:

- The name of your business

- A description of your business’s activities

- Your business address

- The date you started your business

Note: The City of Sacramento mentions that all cannabis businesses must obtain a Conditional Use Permit from Planning and a Business Operating Permit from the Office of Cannabis Policy and Enforcement before applying for a business operation tax account.

Operating A Home-Based Business in Sacramento

If you plan on operating your business out of your home in the City of Sacramento, you must apply for a Home Occupation Permit.

There are several requirements for getting a Home Occupation Permit. For example, your business must be the secondary use of your home, not the primary use. This means you can’t rent a house or apartment for the sole purpose of running a business from it.

The type of business you plan to do from home must also be eligible for a Home Occupation Permit. Finally, specific restrictions exist on what your home-based business can and cannot do. Read all the documentation carefully before applying for a permit.

Sacramento County Business License

If your business is based in an unincorporated part of Sacramento County, you do need to get a license.

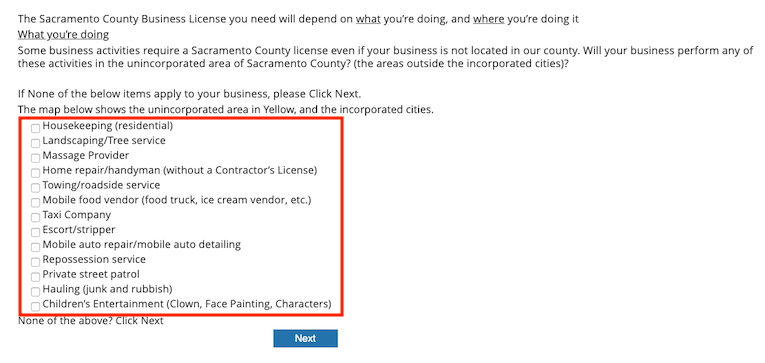

The type of business license you’ll need will depend on what kind of business you’re operating and where it is operating. Certain types of companies may require a county license even if the business is not located in Sacramento County.

The county website offers several resources for determining what license type they need. They provide a general overview of different license types. They also offer a helpful interactive checklist to determine if you need a Sacramento County business license.

Note: Sacramento County does not permit the operation of cannabis dispensaries or related businesses. Licenses to operate these businesses are not available.

West Sacramento

The city of West Sacramento (which is different from the City of Sacramento) promotes itself as being very business-friendly. They list a simple six-step procedure for how to start a business on their website.

Step six of their process is to apply for a business license. The city does require that:

Every person, firm, corporation, partnership, or other business organization occupying real property within the City for business purposes shall obtain a Business License.

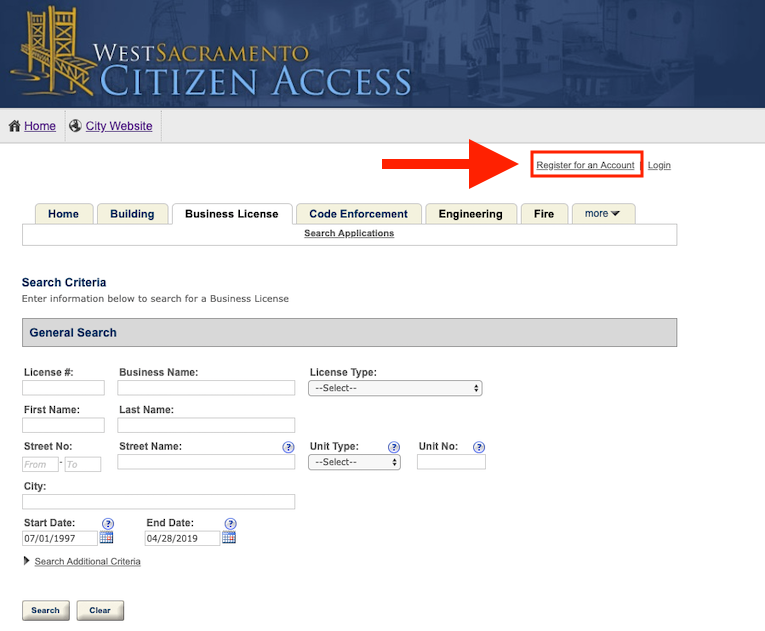

To apply for a business license, you must register for an account on this page.

Like the City of Sacramento, West Sacramento requires cannabis-related businesses to get local approval and a state license before engaging in business activities.

Surrounding Cities And Towns

If you plan to open a business in Rancho Cordova, Folsom, or Roseville, each town has different requirements for obtaining a business license.

Rancho Cordova

All businesses operating from a fixed location must obtain a business license in Rancho Cordova. A General Business License costs $103. Some companies may require a Special Business License, which costs $318 and may include a background check.

Additional information and applications are available on the City of Rancho Cordova website.

Folsom

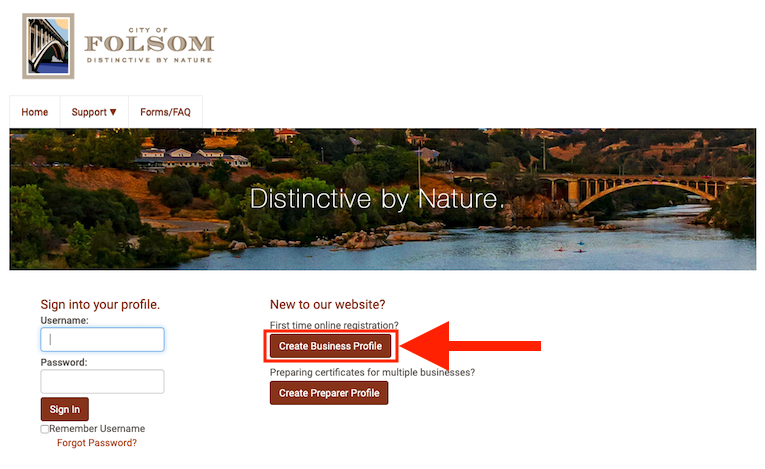

New businesses in Folsom are required to apply for a New Business Certificate. It is functionally the same as a business license, with a different name.

To get started, you’ll need to create a business profile.

Roseville

Getting a business license in Roseville is relatively straightforward. Most of the information can be found on their website.

A note about Roseville business licenses: they are only valid during the calendar year they are issued. This differs from other cities, where your license will be valid for a year from the date it is issued.

For example, if you started a new business in Roseville in December 2024, you would have to get a business license for December 2025 and again in January 2026.

El Dorado Hills

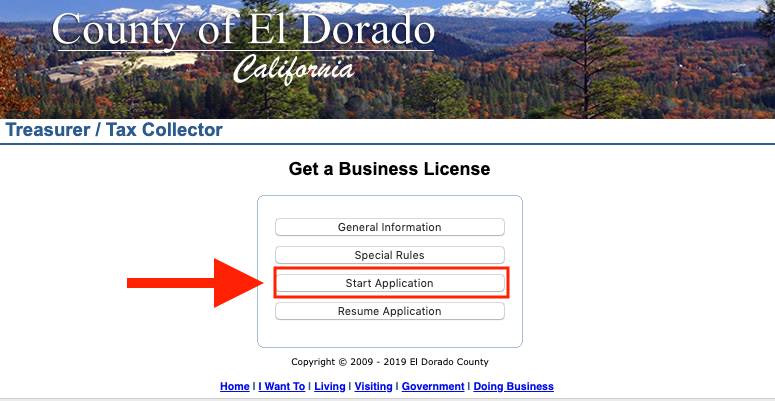

Anyone wishing to do business in El Dorado Hills is required to apply for a business license. You can apply for and renew a business license online through the county website.

Licenses must be renewed each year. For most businesses, the annual renewal fee is $46.00. For certain businesses such as secondhand dealers, pawnbrokers, fortunetelling, and carnivals, the annual license fee is $140.00, plus a $4.00 state fee.

Always Be Prepared

Starting a new business in any city is a big challenge. Whether your business is on a commercial property or based out of your home, you need to know exactly which requirements your business will be subject to before starting operations.

Because each city has its rules and regulations for businesses, it’s essential to take your time and be prepared before you start filling out a business license application.

The good news is that plenty of information is available online from each city’s official website. If you have additional questions, contact the appropriate city departments or officials before moving forward.

Remember that a seller’s permit differs from a business license. A seller’s permit is obtained from the State of California.