As a small business owner or manager, you know how important it is to the business for invoices to be paid on a timely basis.

Today, it’s rare for an accounting department to mail out physical invoices to business customers. Most invoices are emailed. While emailing means instant delivery, there are several potential pitfalls with emailed invoices that should be addressed.

Physical payments—i.e. checks—are still common, as there are no fees associated with checks. However, alternate ways of accepting customer payments can help with timeliness.

The more efficient you are with your internal processes and the better your business leverages today’s technology, the faster invoices will be paid.

Here are ten ideas for how to get paid faster.

Send invoices on a regular schedule

Whether it’s weekly, biweekly or monthly, send invoices on as regular basis as possible.

If a customer is expecting an invoice from your business to show up in their inbox each Tuesday morning or on the 2nd of every month, they’ll be more likely to get into a corresponding approval and payment rhythm.

Accept multiple forms of payment

Most banks do not charge a business for accepting ACH (bank to bank transfer) payments. Ask your customers if they are able to pay via ACH. Have your ACH information ready in a brief document to send them in case they are.

Consider accepting other electronic forms of payment for invoices, including credit cards and PayPal. Some business owners prefer to pay vendor bills by credit card so they can get points.

Request an up-front deposit

When possible, consider asking for a deposit in your proposals.

Most customers won’t object to paying a deposit, but it’s better to set the expectation up front. Also, you can set shorter than normal payment terms on deposit invoices.

Find out if there’s an email address that should be copied on invoices

In many cases, there are multiple people who must approve your invoices for them to get paid — the person who ordered the service and the accounts payable person.

For new customers, ask your primary contact if you should copy an accounts payable email address.

It is often faster for an accounts payable person to get internal approval than it is for an invoice to be routed from a primary business contact to accounting.

Personalize the cover email on invoices

While time billing and accounting systems have email templates for sending out invoices, it may help to personalize the beginning of the email before clicking “send” — even if it’s just a quick, “Thanks, John!”

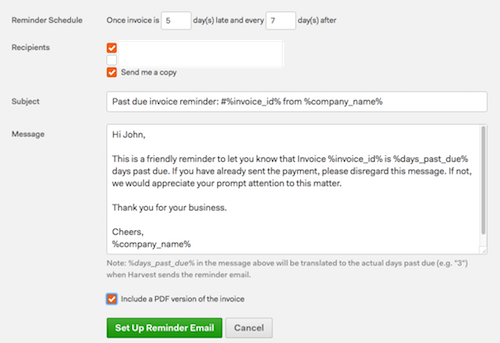

Use a system that has automated reminders

A system that allows you to set recurring reminders on past due invoices will prevent these invoices from languishing.

Integrate your CRM system with your accounting system

If you are using quote-to-order within a CRM application, find out if there is an integration that will automatically transfer orders into your company’s accounting or ERP system. This will save on manual data entry time.

Set up automatic payments for certain customers

If your business both offers a service with a fixed recurring monthly charge and it accepts credit cards, you can set up automatic payments in systems such as ChargeOver and Zoho Subscriptions.

Two ideas for businesses that bill for time and materials:

Generate invoices directly from a time billing system

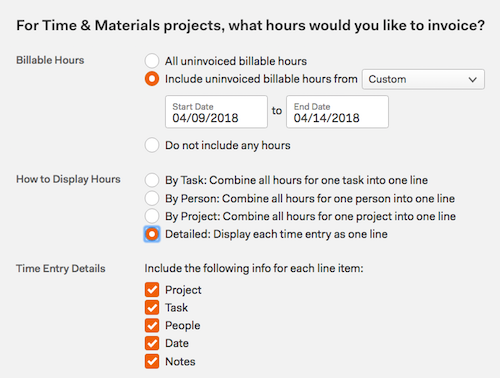

If your company bills on a time & materials basis, time billing systems like Harvest and Paymo can generate invoices with a few clicks. The invoice can be emailed to your customer. It can then be automatically copied into an online accounting system such as Xero or Quickbooks Online so that the receivable can be tracked.

Include sufficient detail in your invoices

Harvest and other time billing applications provide the option to display different levels of detail on an invoice.

An invoice with too little detail, such as a single line item that reads “Project Work – $12,000” might delay payment. If a services invoice is only a single line item, it’s better to add several descriptive bullet points within the description field.

Better still, include details of each time billing entry in invoices.

While every business is different, some of these practices can help your business get paid faster.

About Fortis

![]() Fortis provides business technology services to companies in Northern California. Whether you’re looking for IT Support, business VoIP or faster internet, we are here to answer your questions.

Fortis provides business technology services to companies in Northern California. Whether you’re looking for IT Support, business VoIP or faster internet, we are here to answer your questions.