If you plan to start a business, modify your business model, or sell your products in California, you may have several questions about a California seller’s permit.

A California seller’s permit is required by any business that intends to sell tangible personal property that should be taxed at retail — a sales tax.

Retail means that the buyer is going to use a purchased item themselves. They are not going to resell it.

Personal property can be moved from one location to another — unlike land or buildings, which are considered real property.

We’ll cover what “should be taxed” means below.

You may have heard the term “use tax.” A use tax is related to a sales tax. The buyer pays this tax directly for out-of-state purchases when sales tax has not been applied. Sellers are not responsible for collecting use tax.

Let’s look at some details as to when a seller’s permit application must be submitted and when it does not.

Disclaimer: the following information is based on our research and observations. When in doubt, seek a professional opinion.

State of California entities

In California, the governing board is the Board of Equalization (BOE). The BOE department responsible for seller’s permits is the California Department of Tax and Fee Administration (CDTFA).

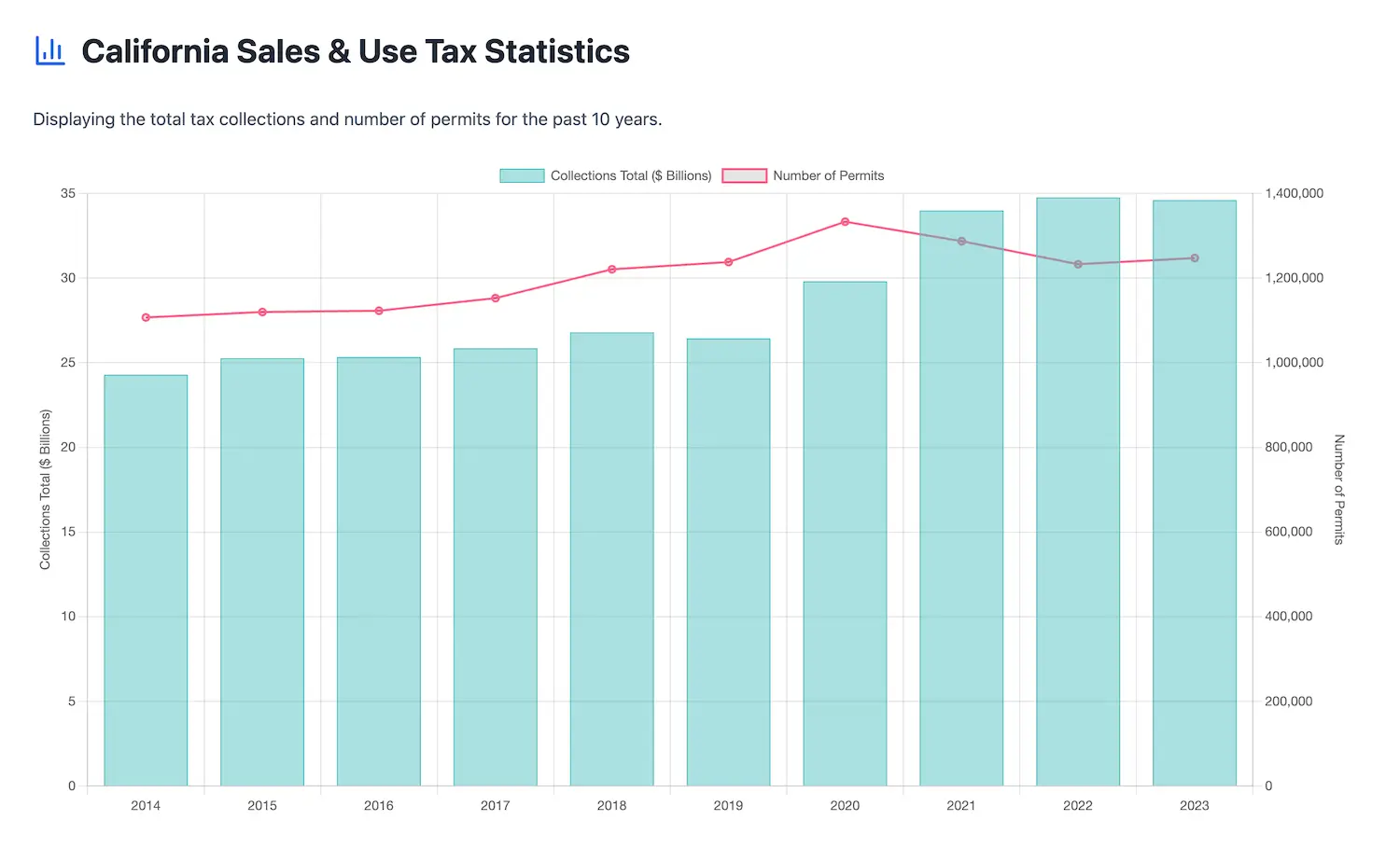

CALIFORNIA SELLER’S PERMITS BY THE NUMBERS

If you do get a permit, you’ll be in good company. At the end of fiscal year 2023, the total permits were 1,247,170. Over $34 billion was collected:

A seller’s permit is different from a business license. All California-based businesses need a local business license. However, not all businesses need a seller’s permit.

In California, a business license (or equivalent) is obtained at the city or county level.

Does your company structure matter?

Even if your business is a sole proprietorship, you will need a seller’s permit if you resell personal, tangible property that should be taxed at retail. Here are the types of entities that require a seller’s permit.

- Individuals

- Partnerships

- Husband/wife Co-ownership

- Corporations

- Organizations

- LLP’s

- LLC’s

Sales volume

What is the threshold amount of sales before collecting sales tax? According to the CDTFA,

“Generally, if you make three or more sales of items subject to California sales and use tax in a 12-month period, you are required to register for a California seller’s permit and pay tax on your taxable sales.”

You do not need a California seller’s permit if you hold one or two garage sales a year. If you have three or more, you technically require a permit.

What about out-of-state companies?

An out-of-state company has a “nexus” and is considered to be engaged in business in the State of California if it:

- Maintains a place of business in California, such as a sales office or warehouse

- Employs a salesperson whose office is within the state’s borders

- Receives rental receipts from equipment located inside California

These businesses are required to collect, pay, and report California sales tax. This post is worth reading if you are an online seller, particularly on Amazon.

What is and is not taxable?

Taxable property includes clothing, furniture, gift items, toys, antiques, vehicles, mobile homes, and aircraft.

Many, but not all, groceries are exempt from sales tax. Prescription medicine and specific medical devices are also exempt.

Are services and labor taxable?

Services and labor are generally not taxable, but there are some exceptions.

Professional services such as legal, accounting, marketing, and IT support are not taxable. Website design services for a business in California are not taxable.

Some service and labor costs are taxable if they result in the creation of tangible personal property. For example, if someone makes a piece of custom jewelry for a customer, they create a tangible personal property. That labor is taxable.

Taxable and non-taxable cousins

Here are several pairings of related items that are viewed differently by the CDTFA:

| Not Taxable | Taxable |

|---|---|

| Cooking Wine | Drinking Wine |

| Flat bottled water | Carbonated/effervescent bottled water |

| Common chewing gum | Medicated gum, such as nicotine gum |

| Unbaked pizza | Freshly baked pizza for pickup or delivery |

| Electronic books, as for a Kindle | Books printed on paper |

If you plan to open a stand at a farmer’s market in California, you will generally not need a California seller’s permit unless you plan to sell an item such as kombucha—which is effervescent and, therefore, taxable. This explains why you don’t see kombucha stands at California farmer’s markets.

Based on the above jeweler scenario, if you were to brew a custom flavor of kombucha requested by a specific customer, both the labor to make the brew and the bottles themselves would technically be taxable.

The intended usage of a taxable item doesn’t change whether or not it’s taxable. If someone plans to do nothing but cook with a bottle of drinking wine, the sale of that bottle is still taxable. If your business sells wine and a customer says they will only use that bottle of 2012 Silver Oak Cabernet for cooking, that will not get you out of needing to collect over $30 in sales tax.

Obtaining a California seller’s permit

People often ask how much a seller’s permit is in California. The answer is that obtaining a seller’s permit in California does not cost anything. In some instances, a security deposit is required.

You can apply for a seller’s permit at the CDTFA Taxpayer Online Services Portal.

Frequently Asked Questions

A California seller’s permit is required by any business that intends to sell tangible personal property that should be taxed at retail.

There is no fee for a seller’s permit in California. However, CDTFA states that it “may require a security deposit to cover any unpaid taxes that may be owed if, at a later date, the business closes.”

A seller’s permit is usually available within 14 business days of the time of online application.

Yes. The CDTFA needs to be notified if there has been a change of address or other business information.

The state requires detailed information on the application form, including but not limited to social security number, date of birth, driver’s license number, banking information, personal references, information about suppliers, and information about bookkeepers and accountants.